A Guide to Ready Reckoner Rates and Guidance Value in Chennai

- 10th Oct 2024

- 1442

- 0

Never miss any update

Join our WhatsApp Channel

The Tamil Nadu government sets Ready Reckoner Rates, also known as Guidance Value, for every property in Chennai.

This guide on GHAR helps you find out details on Guidance Value in Chennai, ready reckoner rates in Chennai and how to check the same online.

Table of Contents

- Latest News on Ready Reckoner Rates in Chennai

- Overview of Ready Reckoner Rates in Chennai

- Area-Wise List of Guidance Value in Chennai (Revised as of 1.07.2024)

- Procedure to Check Guidance Value Online in Chennai

- Why Guidance Value in Chennai is Important

- Summing Up: Guidance Value in Chennai

Chennai's Guideline Value Increases by 10%

A Detailed Look at the Latest Property Price Hike

Government Revises Guideline Values in Chennai, Impacting Property Prices July 2, 2024:

The Tamil Nadu government has implemented a 10% increase in guideline values for land across Chennai, effective July 1, 2024. This revision is expected to drive up property prices across the city, affecting 2.19 lakh streets and 4.46 crore survey and subdivision numbers.

Here are some of the most impacted areas:

Alandur Road: Guideline value increased from ₹5,500 per sq. ft. to ₹6,100 per sq. ft.

Okkiyam-Thuraipakkam: Increased from ₹6,000 per sq. ft. to ₹6,600 per sq. ft.

Abhiramapuram 3rd Street: Increased from ₹16,000 per sq. ft. to ₹17,600 per sq. ft.

Despite an in-depth study conducted by the registration department prior to this update, some builders have expressed concerns, stating that such a sharp increase makes it challenging to adjust. They also worry that this will lead to higher costs for property buyers, further impacting market demand.

What Are Ready Reckoner Rates (Guideline Value) in Chennai?

Each state government sets a minimum rate at which properties can be bought or sold, commonly referred to as the Guideline Value in Tamil Nadu. This is also known as the Ready Reckoner Rate (RRR), Circle Rate, or Guidance Value in other states.

The guideline value represents the minimum benchmark for property registration, ensuring that no property is registered below this rate. When purchasing property, buyers must adhere to this value and pay stamp duty accordingly. This value includes both land and any construction on the property.

Properties must be registered at the higher of the market value or the guideline value. Under no circumstances can properties be registered below the established guideline rate. These values are calculated based on factors like current market prices, available infrastructure, and the nature of the locality.

Revised Area-Wise Guidance Value in Chennai (Effective from July 1, 2024)

The following areas in Chennai have seen significant revisions:

Alandur Road: ₹6,100 per sq. ft.

Okkiyam-Thuraipakkam: ₹6,600 per sq. ft.

Abhiramapuram 3rd Street: ₹17,600 per sq. ft.

This comprehensive list shows how different parts of the city are impacted by the new guideline values, with many areas seeing substantial increases that will likely influence future property transactions.

Area-Wise List of Guidance Value in Chennai (Revised as of 1.07.2024)

The localities listed here fall under Allandur:

| Street Name | Guide value(per sq.m) | Guide Value (per sq.ft) |

|---|---|---|

| Alikan Street | 4400/ Square Feet | 47365/ Square Metre |

| Appavu Street | 4400/ Square Feet | 47365/ Square Metre |

| Asarkana Street | 4400/ Square Feet | 47365/ Square Metre |

| Bramin Street | 5000/ Square Feet | 53820/ Square Metre |

| Dharmaraja Koil Street | 5000/ Square Feet | 53820/ Square Metre |

| Eashwaran Koil Street | 5000/ Square Feet | 53820/ Square Metre |

| Gandhi Market Commer | 6600/ Square Feet | 71045/ Square Metre |

| G.S.T. Road/Mount Road | 11000/ Square Feet | 118405/ Square Metre |

| G.S.T. Roadsouth Side Lawyer Jaganathan Street | 11000/ Square Feet | 118405/ Square Metre |

| Gurupax Street | 4400/ Square Feet | 47365/ Square Metre |

| Hussain Subedar Street | 4400/ Square Feet | 47365/ Square Metre |

| Ibrahim Street | 4400/ Square Feet | 47365/ Square Metre |

| Jal Naiken Street | 4400/ Square Feet | 47365/ Square Metre |

| Jilani Sayabu Street | 4400/ Square Feet | 47365/ Square Metre |

| Kaji Sayabu Street | 4400/ Square Feet | 47365/ Square Metre |

| Kambar Street / Reddy Street | 5500/ Square Feet | 59205/ Square Metre |

| Karpaga Vinayagar Koil Street | 5500/ Square Feet | 59205/ Square Metre |

| Lawyer Jaganatha Street | 5500/ Square Feet | 59205/ Square Metre |

| Marisan Street | 4400/ Square Feet | 47365/ Square Metre |

| Market Lane | 5500/ Square Feet | 59205/ Square Metre |

| Mathavapuram Centre Street | 5000/ Square Feet | 53820/ Square Metre |

| Mathavapuram East Street/ MetreMadhavapuramPerumal East Street | 5000/ Square Feet | 53820/ Square |

| Mathavapuram North Street | 5000/ Square Feet | 53820/ Square Metre |

| Mathavapuram South Street | 5000/ Square Feet | 53820/ Square Metre |

| Mathavapuram West Street | 5000/ Square Feet | 53820/ Square Metre |

| M.K.N Road Mount Sub Way To Cement Road | 6600/ Square Feet | 71045/ Square Metre |

| Mukthamji Street | 5500/ Square Feet | 59205/ Square Metre |

| Nathatchupethar Street | 4400/ Square Feet | 47365/ Square Metre |

| New Street | 5500/ Square Feet | 59205/ Square Metre |

| Reddy Street(Kambar Street) | 5500/ Square Feet | 59205/ Square Metre |

| Sanniyasi Nara Lane | 3900/ Square Feet | 41980/ Square Metre |

| Sanniyasi Subedar Street | 5000/ Square Feet | 53820/ Square Metre |

| Sowri Street | 5000/ Square Feet | 53820/ Square Metre |

| Subba Colony (Subba Reddy Colony) | 5000/ Square Feet | 53820/ Square Metre |

| Thadikkara Swamy Street | 5000/ Square Feet | 53820/ Square Metre |

| U.V. Samynathan Street | 5000/ Square Feet | 53820/ Square Metre |

| Vembuli Subethar Street | 4400/ Square Feet | 47365/ Square Metre |

| Vempuli Amman Koil Street | 5000/ Square Feet | 53820/ Square Metre |

| Venu Reddy Street | 5500/ Square Feet | 59205/ Square Metre |

| Yegambara Dabether | 5000/ Square Feet | 53820/ Square MetreStreet |

Source: Registeration Department, Tamil Nadu

NOTE: The table above only shows the revised guidance value in chennai for localities in Alandur. To view to guidance value in your area, follow the steps in the section below.

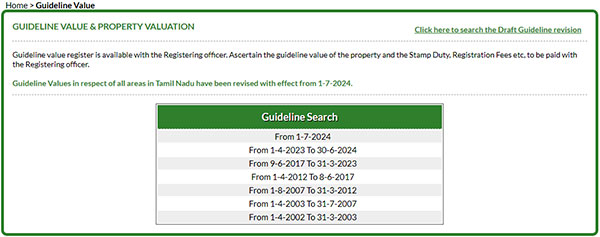

Procedure to Check Guidance Value Online in Chennai

Guideline value is available for more than 1.29 lakh streets and 4.46 billion subdivision numbers on the department website in Tamilnadu. Follow the below steps to check guidance value online -

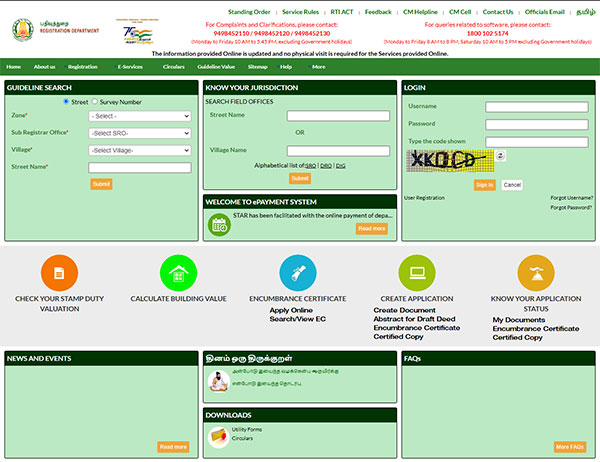

• Login to the Registration Department

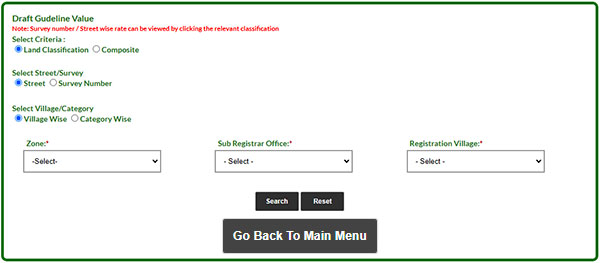

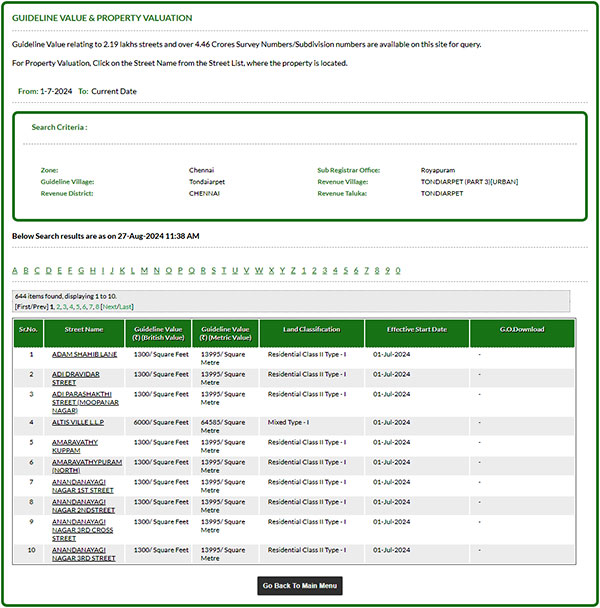

• On the home page, under Guide value Search, you can get the details by Street or Survey Number. Enter the Zone, Sub Register Office, and Village name to get the guidance value.

• Alternatively, you can click on Guide Value on the home page.

• Enter the Survey Number or Street, select the criteria, and enter the Zone, Sub Register Office, and Registration Village. Click on Search to fetch details.

• Below is a sample of the search results obtained

Screenshots from the Official Registration Department Website of Tamil Nadu

Why is Guidance Value Critical for Chennai’s Real Estate?

Guidance Value, also known as Ready Reckoner Rate or Circle Rate in other states, plays a pivotal role in property transactions across Chennai. Here are some key reasons why it’s essential:

Accurate Property Valuation:

The guidance value determines the estimated value of a property, covering all elements involved in purchasing a home in Chennai. This helps buyers make informed decisions.

Stamp Duty and Registration Calculation:

The guidance value is used to calculate both stamp duty and registration charges, which are compulsory in any property transaction. These charges are calculated based on the property's assessed value, making the guidance value crucial for transparency.

Fraud Prevention:

Guidance values help authorities and buyers ensure that properties are not undervalued during sale transactions, thus preventing fraudulent practices and unfair pricing.

Market Value Insights:

For property buyers, the guidance value offers an insight into the market value of the chosen property. This allows for better financial planning, ensuring that buyers are well-prepared for their purchase.

Final Thoughts on Guidance Value in Chennai

In Chennai’s real estate market, knowing the guidance value is vital for both buyers and sellers. It serves as the foundation for property registration and helps calculate accurate stamp duty. We hope this blog has given you a clearer understanding of why guidance values are essential in Chennai and how they affect your property transactions.

Frequently Asked Questions

Q: What is the Ready Reckoner Rate?

A: The Ready Reckoner Rate, also called Circle Rate, is the standard value set by the state government to regulate the sale and purchase of immovable property.

Q: How is property value calculated using the circle rate?

A: Property value is determined by multiplying the ready reckoner rate (per square meter) of a location by the built-up area (in square meters). This value helps in calculating stamp duty and registration charges.

Q: What factors influence the circle rate?

A: Several factors impact the circle rate, including the age of the property, location, available facilities, type of property, and tenancy purpose.

Q: What is the difference between market value and circle rate?

A: The Circle Rate is the minimum value at which a property can be sold or bought, while the market value is the actual price at which property transactions occur in the market.

Admin

Admin

Comments

No comments yet.

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading blogs