Comprehensive Guide to IGR Maharashtra - Registration & Stamp Department 2024

- 22nd Jun 2024

- 1668

- 0

Never miss any update

Join our WhatsApp Channel

This guide on Ghar helps you find everything you need to know about the IGR Maharashtra, the official department for registration and stamps in the state. Find essential services offered by IGR Maharashtra, including property registration, stamp duty calculation, and much more.

Stay informed and make the most of the online portal for seamless property-related transactions.

Table of Contents

- Introduction to IGR MaharashtraKey Services Offered by IGR Maharashtra

- Key Services Offered by IGR Maharashtra

- How to Calculate Stamp Duty in Maharashtra

- Searching Property Registration Details

- Payment of Stamp Duty and Registration Fees

- Applying for Stamp Duty Refund

- Checking Ready Reckoner Rates Online

- Required Documents for Stamp Duty and Registration Charges

- Document Handling Charges on IGR Maharashtra

- Other Services Provided by IGR Maharashtra

- Accessing Land Records on IGR Maharashtra

- IGR Maharashtra Mobile Application

- Contact Information for IGR Maharashtra

- Conclusion

1. Introduction to IGR Maharashtra

IGR Maharashtra is the official department responsible for registration and stamps in the state. It offers a range of services through its online portal, making it easier for citizens to access property-related information and perform transactions seamlessly.

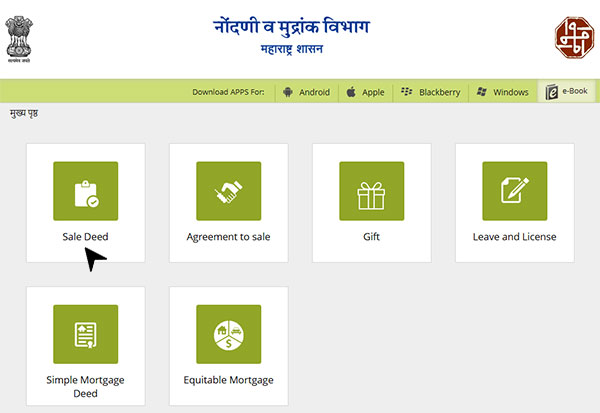

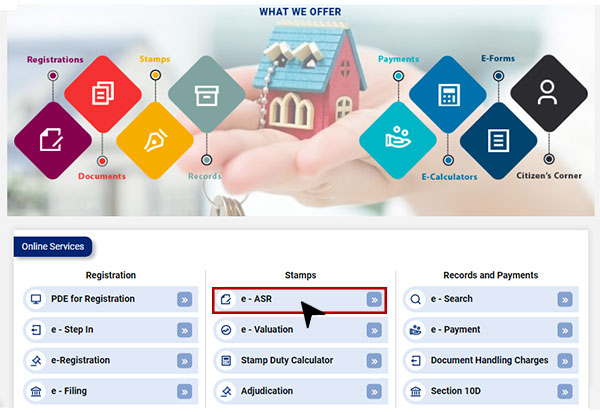

2. Key Services Offered by IGR Maharashtra

The IGR Maharashtra portal provides numerous services, including property document registration, stamp duty calculation and payment, property valuation, stamp duty refunds, and marriage registration. These services minimize the need to visit the Sub-registrar office.

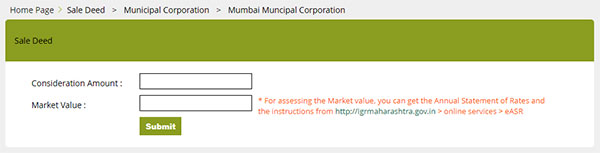

3. How to Calculate Stamp Duty in Maharashtra

Stamp duty is a tax payable on registering legal documents. The IGR Maharashtra website allows users to calculate stamp duty charges online through a user-friendly Stamp Duty Calculator.

Follow these steps to calculate your stamp duty:

- Visit the official IGR Maharashtra website.

- Click on the 'Stamp Duty Calculator' tab.

- Enter the document details and select the relevant options.

- Click 'Calculate' to view the stamp duty amount.

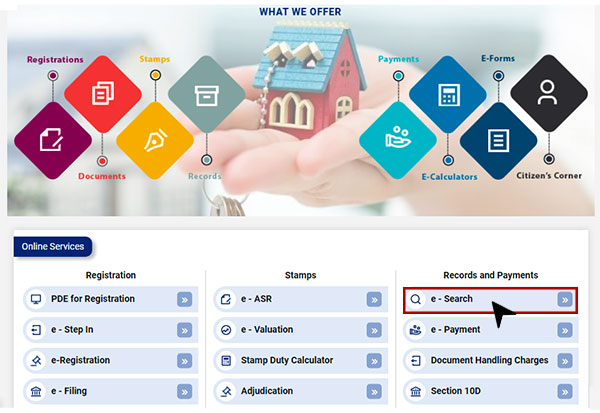

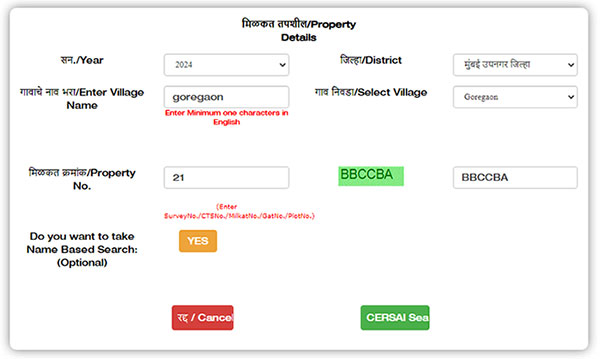

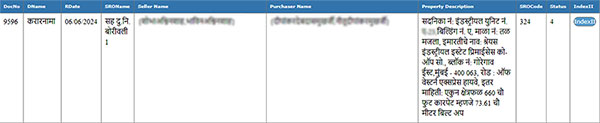

4. Searching Property Registration Details

The IGR Maharashtra website provides a free search tool for finding property registration details. This tool covers properties registered in Mumbai since 1985 and other areas since 2002.

Follow these steps to search for property registration details:

- Visit the IGR Maharashtra website.

- Click on 'E-search' and select the free process option.

- Register or log in.Enter property details and select the relevant options.

- Download the registration details in PDF format.

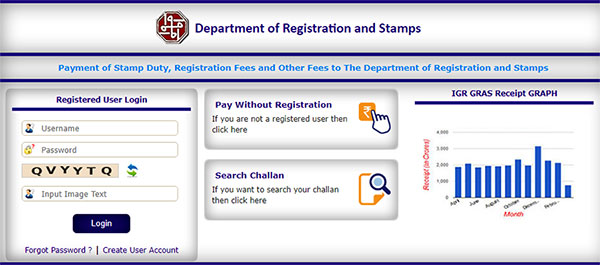

5. Payment of Stamp Duty and Registration Fees

Once stamp duty is calculated, it can be paid online through the Government Receipt Accounting System (GRAS).

Follow these steps to pay stamp duty and registration fees:

- Visit the GRAS website.

- Click on the Inspector General of Registration tab.

- Select the required payment option.

- Enter the necessary details and choose a payment method.

- Proceed to complete the payment.

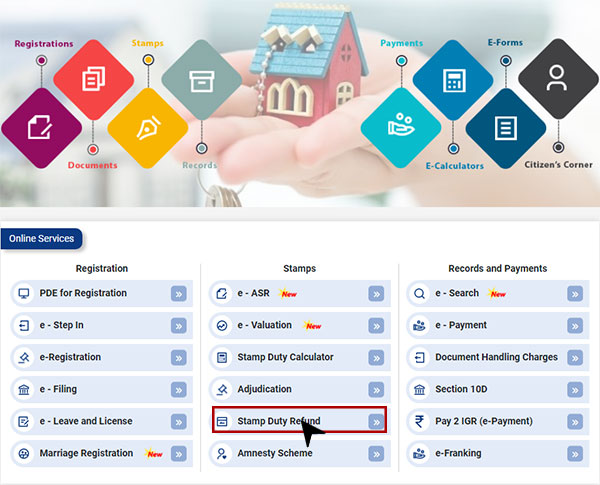

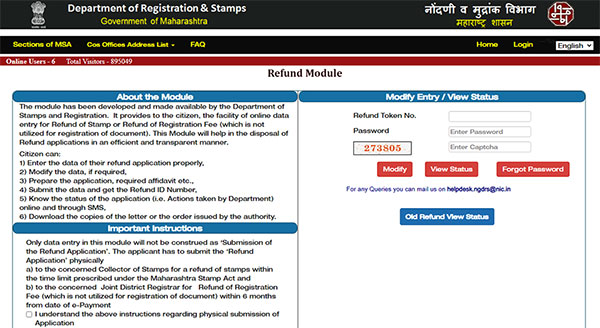

6. Applying for Stamp Duty Refund

IGR Maharashtra allows users to apply for stamp duty refunds online.

Follow these steps to apply:

- Visit the official IGR Maharashtra website.

- Click on the 'Stamp Duty Refund' tab.

- Enter the refund token number and password.

- View the refund status on the screen.

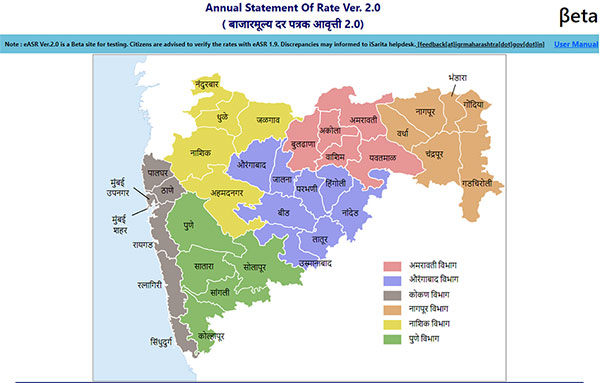

7. Checking Ready Reckoner Rates Online

Ready reckoner rates are the minimum property transaction rates decided by the government.

Follow these steps to check the latest rates:

- Visit the IGR Maharashtra website.

- Click on the 'E-ASR and Process' tab.

- Select the concerned district on the map.

- View the rates by selecting the district, taluka, and village.

8. Required Documents for Stamp Duty and Registration Charges

To register a property in Maharashtra, you need the following documents:

- Aadhaar Card

- Passport-sized photos of the buyer and seller

- Original sale deed and verified copy

- Municipal tax bill copy

- Construction completion certificate

- Latest property register card copy

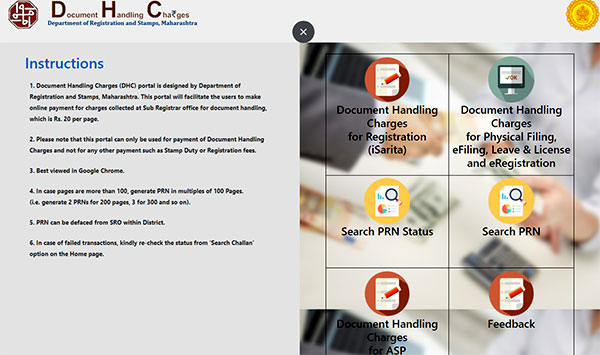

9. Document Handling Charges on IGR Maharashtra

When using the IGR Maharashtra portal, you may need to pay document handling charges. Here are the key points:

- Visit the IGR Maharashtra website.

- Click on the 'Document Handling Charges' link.

- Follow the instructions and make the payment online.

- The fee is INR 20 per page.

10. Other Services Provided by IGR Maharashtra

IGR Maharashtra offers additional services such as e-registration of property (first sale only), time slot booking for registration at Sub-Registrar offices, e-filing of mortgage deeds, property valuation, and marriage registration.

11. Accessing Land Records on IGR Maharashtra

To access land records, visit the IGR Maharashtra homepage and click on the 'records' section. You will be redirected to the Bhulekh Mahabhumi website, where you can view land records.

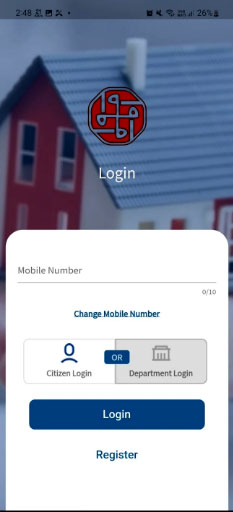

12. IGR Maharashtra Mobile Application

The SARATHI IGR mobile application is available for Android and iOS users. It improves user-friendliness and offers features such as stamp duty calculation and property information access. Download it from Google Play Store or Apple App Store.

13. Contact Information for IGR Maharashtra

Office Address:Office of the Inspector General of Registration and Controller of Stamps,Ground Floor, Opposite Vidhan Bhavan (Council Hall), New Administrative Building, Pune 411001, Maharashtra, India.Phone Number: 020-26124012, 8888007777

Email Addresses:

- To register a complaint: [email protected]

- To share your feedback: [email protected]

- To give portal enhancement suggestions: [email protected]

Conclusion

The IGR Maharashtra portal has streamlined citizen-centric services, allowing easy access to stamp payment, stamp duty refund, challan search, ready reckoner rates, and property search. The portal promotes transparency and efficiency in service delivery, making property-related transactions hassle-free.

Admin

Admin

Comments

No comments yet.

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading blogs