Comprehensive Guide to Stamp Duty and Registration Charges in Maharashtra 2024

- 29th Jun 2024

- 1935

- 0

Never miss any update

Join our WhatsApp Channel

Discover everything you need to know about stamp duty and property registration fees in Maharashtra’s urban and rural areas, including Mumbai, Nagpur, Pune, and more, in this comprehensive guide.

Table of Contents

- About Stamp Duty in Maharashtra

- Stamp Duty Charges and Levies in Maharashtra (Rural and Urban)

- Stamp Duty in Maharashtra in 2024

- Stamp Duty in Mumbai

- Stamp Duty for Resale Flats in Mumbai 2024

- Ways to Pay Stamp Duty in Maharashtra

- Online Payment of Stamp Duty (Step-by-Step)

- New Amnesty Scheme for Stamp Duty in Maharashtra

- More About the Amnesty Scheme

- Factors Affecting Stamp Duty and Registration Charges

- Notice of Intimation for Stamp Duty and Registration Fees

- Stamp Duty on Gift Deed, Lease Deed, and Others

- Tax Savings on Stamp Duty

- Refund of Stamp Duty in Maharashtra

- Apply for Stamp Duty Refund Online

- Search Challan for Stamp Duty

- List of Available Banks for E-Challan

- Need to Pay Stamp Duty on Past Property Documents?

- Adjudication of Stamp Duty in Maharashtra

- Section 10D of the Maharashtra Stamp Act

- Conclusion

- Latest News and Updates

INTRODUCTION

Stamp duty and registration charges are crucial aspects of property transactions in Maharashtra. This guide provides detailed insights into the applicable rates, methods of payment, factors affecting the charges, and the latest updates for 2024. Learn how to navigate the complexities of stamp duty and make informed decisions for your property transactions.

ABOUT STAMP DUTY IN MAHARASHTRA

Stamp duty in Maharashtra is applicable on property deals across the state. The charges are regulated under the Maharashtra Stamp Duty Act. To support homeownership and the real estate sector during the economic crisis caused by the COVID-19 pandemic, the Maharashtra government temporarily reduced stamp duty rates. However, the rates were reinstated in April 2022. A bill passed in March 2022 offers a waiver on stamp duty for resale properties for one to three years, calculated on the difference in the property's value rather than its overall price.

STAMP DUTY CHARGES AND LEVIES IN MAHARASHTRA (RURAL AND URBAN)

Stamp duty in Maharashtra includes additional taxes:

- Urban Areas: 1% cess/transport surcharge/local body tax for funding transport infrastructure projects.

- Rural Areas: 1% Zilla Parishad cess replacing urban cess.

- Nagpur: An additional 0.5% surcharge for areas under Nagpur Municipal Corporation and Nagpur Improvement Trust jurisdictions.

STAMP DUTY IN MAHARASHTRA IN 2024

| Cities in Maharashtra | Men (From April 2022 till date) | Men (From April 2022 till date) | Registration Charges |

|---|---|---|---|

| Mumbai | 6% including 1% Metro cess | 5% including 1% Metro cess | Rs 30000 for properties above Rs.30 Lakh |

| Thane | 7% including 1% Metro cess, transport surcharge and local body tax | 6% including 1% Metro cess, transport surcharge and local body tax | |

| Nagpur | 7% including 1% Metro cess, transport surcharge and local body tax | 6% including 1% Metro cess, transport surcharge and local body tax | 1% of the property value for properties below Rs.30 Lakh |

| Pune | 7% including 1% Metro cess, transport surcharge and local body tax | 6% including 1% Metro cess, transport surcharge and local body tax | |

| Navi-Mumbai | 6% including 1% Metro cess, transport surcharge and local body tax | 5% including 1% Metro cess, transport surcharge and local body tax | |

| Pimpri-chichwad | 5-6% depending on the area | 4-5% depending on the area |

Current stamp duty rates for 2024 have been reinstated to their previous values after the temporary reduction during the pandemic.

STAMP DUTY IN MUMBAI

Stamp duty in Mumbai varies based on the type and location of the property. The charges for different areas and property types are detailed below.

| Stamp duty charges in mumbai | Registration fees in mumbai | |

|---|---|---|

| Male | 6% (5% Stamp duty + 1% Metro Cess) |

|

| Female | 5% (4% Stamp duty + 1% Metro Cess) |

|

|

Joint(Male+ Femal) |

6% |

|

STAMP DUTY FOR RESALE FLATS IN MUMBAI 2024

Understand the specific stamp duty charges applicable for buying resale flats in Mumbai in 2024.

| Mumbai Areas | Stamp duty in Mumbai for males | Stamp duty in Mumbai for Females | Registration fees |

|---|---|---|---|

| Within the municipal areas of urban area | 6% of the market of the property | 5% of the market of the property | 1% of the market of the property |

| Within the limits of any Panchayat/municipal council/ cantonment of any area within MMRDA | 4% of the market of the property | 3% of the market of the property |

1% of the market of the property |

| Within the area of any Gram panchayat | 3% of the market of the property | 2% of the market of the property | 1% of the market of the property |

WAYS TO PAY STAMP DUTY IN MAHARASHTRA

Different methods to pay stamp duty include:

- Stamp Paper: Traditional method using physical stamp paper.

- Franking: Agreement printed on paper and processed through an authorized bank's franking machine.

- E-Stamping: Convenient online method using RTGS or NEFT for payment.

ONLINE PAYMENT OF STAMP DUTY (STEP-BY-STEP)

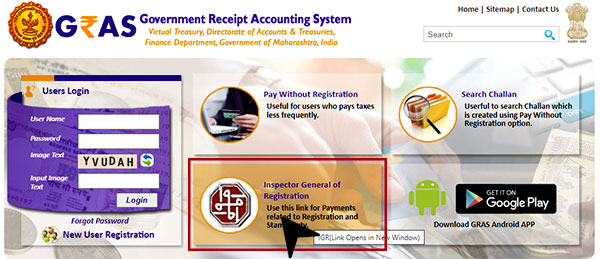

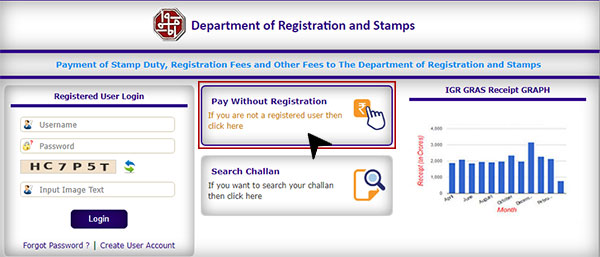

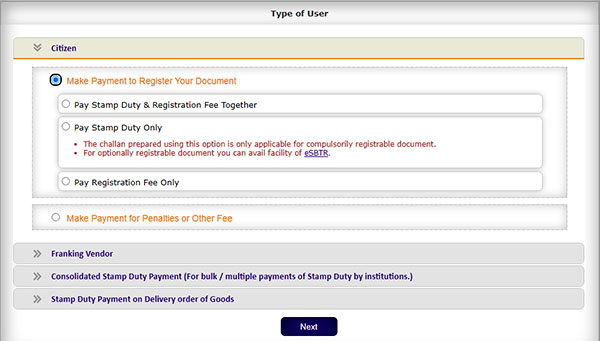

Step-by-Step Guide:

- Log on to the Maharashtra Stamp Duty Online Payment portal.

- Click 'Pay Without Registration'.

- Choose 'Make payment to Register your documents'.

- Fill in details such as district, payer's name, PAN, property details, and value.

- Select payment method and generate the challan.

NEW AMNESTY SCHEME FOR STAMP DUTY IN MAHARASHTRA

The Maharashtra government has launched an amnesty scheme for unpaid or underpaid stamp duty:

- Phase 1: December 1, 2023, to January 31, 2024.

- Phase 2: February 1, 2024, to March 31, 2024 (extended to June 30, 2024).

MORE ABOUT THE AMNESTY SCHEME

Key details of the scheme:

- Necessary due to insufficiently stamped documents.

- Offers waivers and discounts on stamp duty and penalties based on outstanding amounts and timeframes.

FACTORS AFFECTING STAMP DUTY AND REGISTRATION CHARGES

Major factors include:

- Type of Property: Residential vs. commercial.

- Age of the Property: New vs. old properties.

- Age of the Buyer: Senior citizen discounts.

- Location: Based on ready reckoner rates.

- Gender of the Buyer: Reduced rates for women.

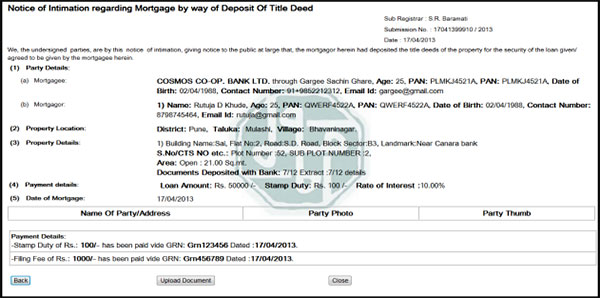

NOTICE OF INTIMATION FOR STAMP DUTY AND REGISTRATION CHARGES

Online and physical methods for filing the Notice of Intimation (NOI) for loan deposits, title deeds, or mortgages.

STAMP DUTY ON GIFT DEED, LEASE DEED, AND OTHERS

Stamp duty for gift deeds, lease deeds, and other instruments as per the Maharashtra Stamps Act 2017.

| Stamp duty in Maharashtra on various deeds | |

|---|---|

| Type of Deed | Stamp duty |

| Gift deed | 3% |

| Lease | 5% |

|

Gift deed family (Residential/agricultural property) |

Rs 200 |

|

Power of atorny |

5%- For properties in Muncipal areas 3% for properties located in gram panchayat areas. |

TAX SAVINGS ON STAMP DUTY

Income tax deductions under Section 80C for stamp duty, cess/surcharge, and registration charges, up to Rs 1.5 lakh.

REFUND OF STAMP DUTY IN MAHARASHTRA

Conditions for stamp duty refund:

- Non-signature by essential parties.

- Refusal to sign or non-fulfilment of terms.

- Errors or illegal transactions.

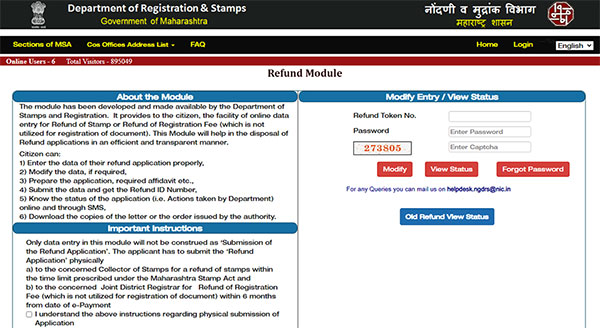

APPLY FOR STAMP DUTY REFUND ONLINE

Steps to apply for a refund:

- Log in to the Maharashtra stamp duty refund portal.

- Accept terms and conditions.

- Enter mobile number, OTP, and captcha code.

- Fill in personal and document details.

SEARCH CHALLAN FOR STAMP DUTY

Steps to search for a challan online on the Mahakosh portal.

LIST OF AVAILABLE BANKS FOR E-CHALLAN

Procedure to get the list of banks providing E-challan facilities on the GRAS website.

| IDBI Bank | Punjab National bank | State bank of india | Allahabad bank | Andhra Bank |

|---|---|---|---|---|

| Bank of Baroda | Bank of india | Bank of maharashtra | Canara Bank | Central bank of india |

| Corporation bank | Dena bank | Indian bank | Indian Overseas Bank | Union Bank |

| Vijaya bank | Syndicate bank | Uco bank | Oriental bank of commerce |

NEED TO PAY STAMP DUTY ON PAST PROPERTY DOCUMENTS?

The collector can verify past property documents for appropriate stamp duty payment within ten days of registration.

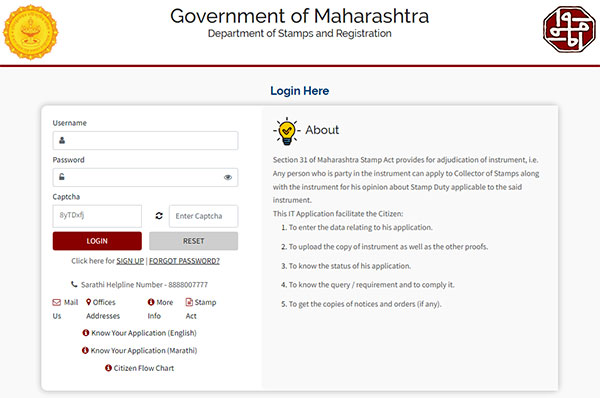

ADJUDICATION OF STAMP DUTY IN MAHARASHTRA

Process for adjudication under Section 31 of the Maharashtra Stamp Act.

SECTION 10D OF THE MAHARASHTRA STAMP ACT

Ensures correct payment of stamp duty and registration charges by authorized bodies.

CONCLUSION

Stamp duty in Maharashtra is a significant aspect of property transactions, with varying rates and regulations based on multiple factors. Stay informed and follow the procedures to ensure compliance.

Admin

Admin

Comments

No comments yet.

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading blogs