How Will Budget 2023 Impact Real Estate in India?

- 1st Feb 2023

- 1981

- 0

Never miss any update

Join our WhatsApp Channel

Budget 2023 - Impact on Real Estate in India

As Finance Minister Nirmala Sitharaman delivered her fifth budget statement on February 1, 2023, she included a number of long-term and short-term policies to propel the Indian real estate industry to new heights.

Several significant developments in the Union Budget for 2023 directly or indirectly affect the real estate and infrastructure industries.

- Infrastructure and productive capacity investments have a significant multiplier effect on economic development and employment.

- After a period of decline due to the epidemic, private investments are regaining momentum.

- The Budget 2023 retakes the initiative to accelerate the cycle of investment and employment creation.

Ghar.tv looks at a few key real estate takeaways from India budget 2023:

PMAY:

The budget for the Pradhan Mantri Awas Yojana (PMAY) has been increased by 66% to about Rs 79,000 crore.

This attention to low cost and affordable housing in India surely brings back focus to the fact that 'Ghar' is in reality a fundamental right of every human being. It is not just an investment option that the modern world has made it into.

Capital Gains on Joint Development

As consideration, the finance minister recommended modifying the regulations for calculating capital gains in the event of joint development of a property to include amounts received by cheque, etc. for the same.

Claiming Deductions

Although interest paid on borrowed money for purchasing or renovating a property may be deducted from income under certain situations, it can also be included in the cost of purchase or improvement upon transfer, so lowering capital gains. It is suggested to prohibit the inclusion of previously claimed interest deductions in the cost of acquisition or renovation.

54 & 54F

In order to improve the targeting of tax discounts and exemptions, the Finance minister recommended capping the deduction for capital gains on residential property investments under sections 54 and 54F at INR 10 crore.

Another proposal with a mirroring objective would restrict the income tax exemption for the profits of very valuable insurance plans.

Green buildings

"We are implementing several programmes for green fuel, green energy, green farming, green transportation, green buildings, and green equipment, as well as policies for energy efficiency in different economic sectors. These green growth initiatives contribute to a reduction in the carbon intensity of the economy and provide substantial green employment prospects."

Minister of Finance - Nirmala Sitharaman

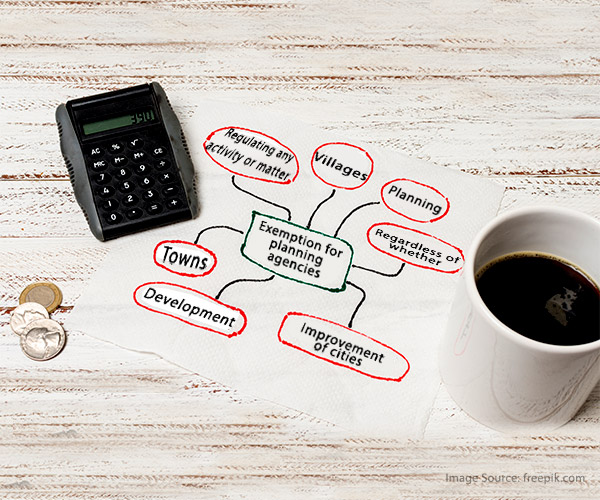

Exemption for planning agencies

It is proposed to exempt from taxation any income derived by a body, authority, board, trust, or commission (other than a company) that has been established or constituted by or under a Central or State Act for the purposes of satisfying the need for housing or for planning, development, or improvement of cities, towns, or villages or for regulating any activity or matter, regardless of whether or not it is engaged in commercial activity.

Preparing cities for municipal bonds

Cities will be motivated to enhance their municipal bond creditworthiness by instituting property tax governance changes and ring-fencing user charges on urban infrastructure.

Nonbanking financial institutions (NBFCs)

Due to changes in the Reserve Bank of India's (RBI) categorization of non-banking financial entities, it is suggested to make the required revisions to the Act to reflect these changes.

Gearing up Cities for Sustainability

States and municipalities will be urged to implement urban planning changes and initiatives that will convert our cities into "sustainable cities of the future." This entails effective use of land resources, sufficient funding for urban infrastructure, transit-oriented development, increased availability and affordability of urban land, and the creation of opportunities for everyone.

Enhancing Infrastructure Private Investment Opportunities

The newly created Infrastructure Finance Secretariat will aid all stakeholders in increasing private investment in infrastructure, including as trains, highways, urban infrastructure, and electricity, which rely mostly on public funding.

Urban Infrastructure Development Fund

Similar to the RIDF, an Urban Infrastructure Development Fund (UIDF) will be formed by using the loan shortage in the priority sector. This will be maintained by the National Housing Bank and used by governmental agencies in Tier 2 and Tier 3 cities to build urban infrastructure. States will be urged to use resources from 15th Finance Commission funds as well as existing schemes in order to implement suitable user fees when using the UIDF.

Cooperative societies

Cooperative societies now have a greater maximum of Rs 3 crore for tax deducted at source (TDS) on cash withdrawals.

Non-Indian residents (NRIs)

It is suggested to modify the time limit for submitting an appeal against the decision of the adjudicating body under the Benami Act to 45 days from the day the initiating officer or the aggrieved person receives the order. It is also recommended to amend the definition of "high court" so that non-residents may determine the court's appellate jurisdiction.

Updates on Special Economic Zone (SEZ)

It is suggested to impose a restriction on the amount of time a SEZ firm has to bring export revenues into India. It is also planned to make submitting a tax return obligatory for claiming export revenue deductions.

Boosting GIFT IFSC

To increase commercial activity at GIFT IFSC, the following steps will be taken:

- Delegating authority under the SEZ Act to IFSCA to prevent duplication of regulation

- Establishing a centralised IT registration and approval mechanism for IFSCA, SEZ authorities, GSTN, RBI, SEBI, and IRDAI.

- Permitting purchase financing by foreign banks' IFSC Banking UnitsEstablishing an EXIM Bank subsidiary for trade re-financing.

- Adding legislative provisions for arbitration and related services to the IFSCA Act, and avoiding duplicate regulation under the SEZ Act.

- Recognizing offshore derivative instruments as contractually binding.

- Extending tax breaks for money shifting to IFSC, GIFT City till March 31, 2025.

- For nations seeking digital continuity solutions, we will support the establishment of their Data Embassies inside the GIFT IFSC.

Admin

Admin

Comments

No comments yet.

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading blogs